Blog Details

Dax 40 Dives as Equity Rout Widens After Fed Chair Powell Returned to Hawkish Script ( Aug 29, 2022)

The Dax 40 gapped lower to start the week as the ramifications of Federal Reserve Chair Jerome Powell address on Friday left markets reeling. He stated that the central bank is focused on getting inflation back down to around 2%.

His address at the Jackson Hole symposium made it clear that the Fed expects growth to slow as a result of their tightening and that households will feel some pain in the process. The confusion around his remarks of the current rate being neutral appear to have been addressed.

Global equity markets and risk assets in general have continued lower following Friday’s softness. China’s CSI 300 and Hong Kong’s Hang Seng indices were down to a lesser degree as the People’s Bank of China (PBOC) set the Yuan at a stronger than anticipated rate of 6.8696.

Treasury yields have been boosted across the curve, with the 2-year note approaching 3.5%, the highest since 2007.

The US Dollar is stronger across the board, most notably against the Japanese Yen and Australian Dollar. Australian retail sales were much stronger than forecast, coming in at 1.3% for the month of July instead of 0.3%.

Gold is also lower, trading near US$ 1,722 at the time of going to print.

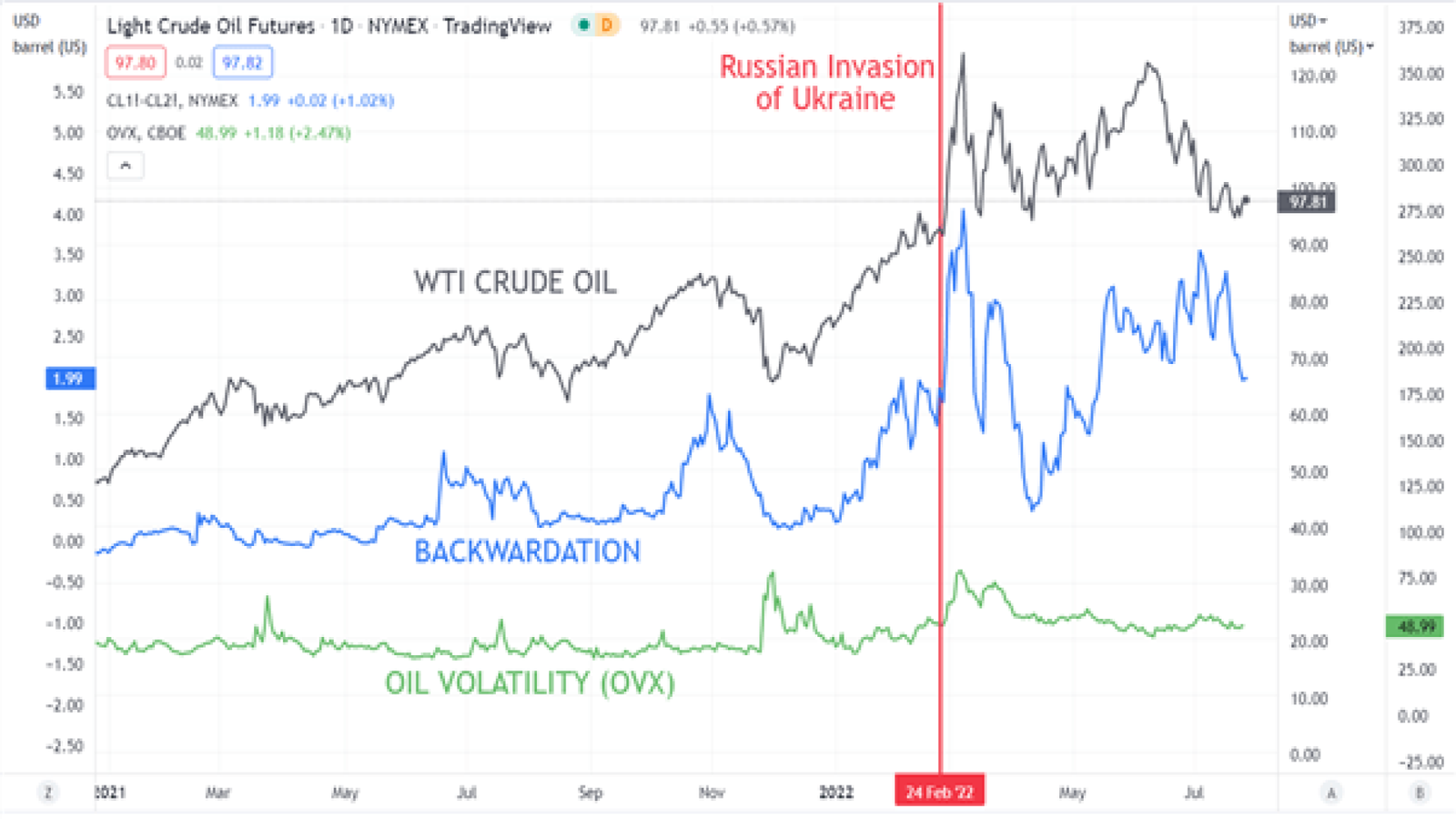

The Canadian Dollar has fared ‘least-worst’ of the majors with crude oil gaining through the Asian session.

Speculation is swirling that the United Arab Emirates and Oman support the views expressed by Saud Arabia last week that production could be cut if prices fall. Political unrest in Libya has the market guessing that their production may come under threat.

Additionally, hopes have been dashed of a prompt resolution in resurrecting the 2015 US-Iran nuclear accord. Without Iranian oil returning to global markets supply remains tight, as result the WTI futures contract is back above US$ 94 bbl while the Brent contract is a approaching US$ 102 bbl.

The European benchmark Dutch Title Transfer Facility (TTF) natural gas futures contract has continued higher, trading above 346 Euro per Mega Watt hour (MWh) against the June low of 80 Euro per MWh.

Data is a bit light on to start the week, but there will be commentary from ECB and Fed crossing the wires.